As I sat on a flight back from a hackathon, where we brainstormed innovative solutions for achieving financial independence, I couldn’t help but think about the Lean FIRE vs Fat FIRE debate. It’s a choice many of us face: do we adopt a more austere approach to saving, or do we prioritize enjoying our lives while still working towards financial freedom? I’ve seen friends and colleagues struggle with this decision, and I’ve been there myself. The dilemma is real, and it’s one that requires careful consideration of our values, goals, and priorities.

In this article, I’ll cut through the noise and provide you with a no-nonsense look at the pros and cons of each approach. I’ll share my own experiences, as well as insights from my work as a business strategy consultant, to help you make an informed decision. My goal is to empower you with practical advice, not to sway you towards one approach or the other. By the end of this article, you’ll have a clearer understanding of what Lean FIRE and Fat FIRE entail, and you’ll be better equipped to choose the path that’s right for you.

Table of Contents

Lean FIRE

Lean FIRE is a financial independence strategy that involves living extremely frugally and saving a large percentage of one’s income, with the goal of retiring early, often in one’s 40s or 50s. The core mechanism of Lean FIRE is aggressive saving, where individuals cut back on all non-essential expenses and invest their savings in a tax-efficient manner to maximize returns. The main selling point of Lean FIRE is its promise of rapid wealth accumulation, allowing individuals to achieve financial independence in a relatively short period.

I’ve seen firsthand how Lean FIRE can be a powerful catalyst for transformation, as individuals who adopt this approach often experience a sense of liberation from the burdens of consumer debt and expensive lifestyles. By living below their means and investing wisely, they can create a safety net that provides peace of mind and freedom to pursue their passions, rather than just working for a paycheck. As someone who’s worked with numerous clients on their financial strategies, I can attest that Lean FIRE is not just about saving money – it’s about creating a lifestyle of intention, where every dollar is aligned with one’s values and goals.

Fat FIRE

Fat FIRE, on the other hand, is a financial independence strategy that involves maintaining a high income and saving a significant portion of it, while still enjoying a relatively luxurious lifestyle. The core mechanism of Fat FIRE is high-income generation, where individuals focus on increasing their earnings potential through advanced degrees, high-paying careers, or entrepreneurial ventures. The main selling point of Fat FIRE is its promise of sustainable wealth creation, allowing individuals to achieve financial independence while still enjoying many of the comforts and luxuries of life.

As a business strategy consultant, I’ve worked with numerous high-income earners who’ve adopted the Fat FIRE approach, and I can see how it allows them to balance ambition with enjoyment. By maintaining a high income and saving aggressively, they can create a wealth snowball that provides long-term financial security, while still indulging in their passions and interests. Fat FIRE is not just about accumulating wealth – it’s about living life on one’s own terms, where financial independence is not just a destination, but a journey of personal growth and fulfillment.

Head-to-Head Comparison: Lean FIRE vs Fat FIRE

| Feature | Lean FIRE | Fat FIRE |

|---|---|---|

| Savings Rate | 50-70% of income | 20-40% of income |

| Retirement Goal | Extreme frugality for early retirement | Luxurious lifestyle in retirement |

| Investment Strategy | Aggressive investing for rapid wealth growth | Conservative investing for stable wealth growth |

| Time to Retirement | 5-10 years | 10-20 years |

| Annual Expenses | $20,000-$30,000 | $50,000-$100,000 |

| Lifestyle | Frugal, minimalist | Luxurious, high-end |

| Best For | Young individuals, simple lifestyles | High-income earners, those wanting comfort in retirement |

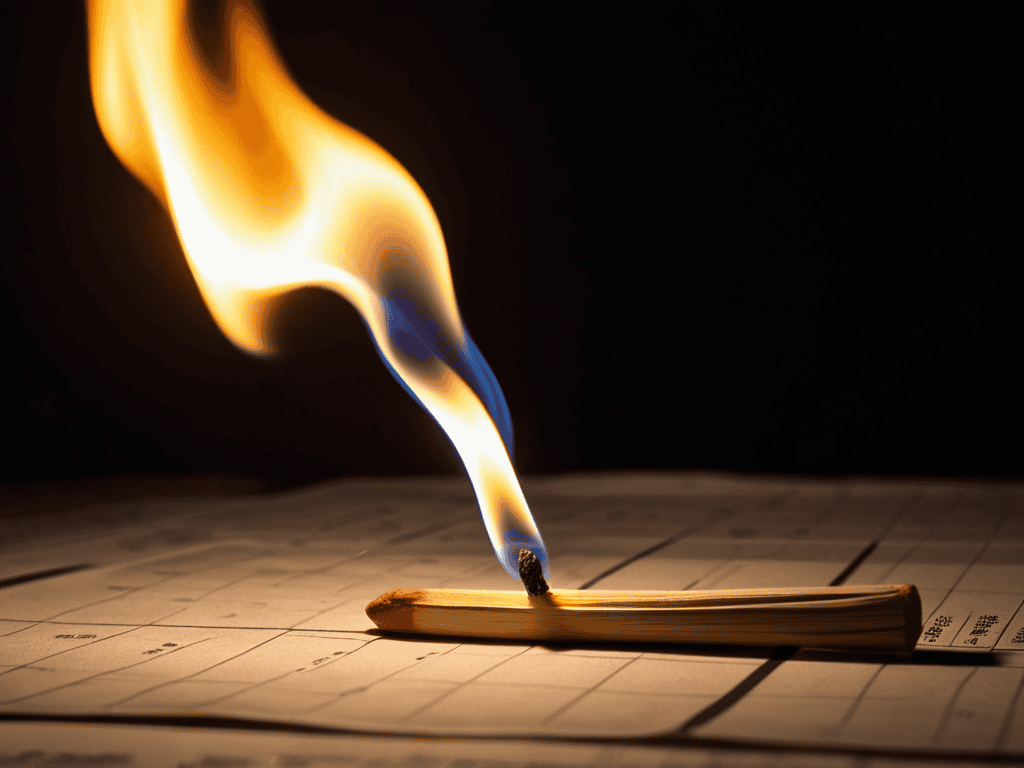

Igniting Lean Fire vs Fat Fire

When it comes to achieving financial independence, the ability to ignite your journey is crucial. This is where the concept of igniting Lean FIRE vs Fat FIRE comes into play, as it determines how quickly and efficiently you can start building wealth. The criterion of igniting your financial independence plan is critical because it sets the tone for your entire journey.

In a head-to-head analysis, Lean FIRE and Fat FIRE have distinct approaches to igniting their respective plans. Lean FIRE focuses on aggressive savings and frugal living, allowing individuals to quickly accumulate wealth and invest in assets that generate passive income. This approach enables them to ignite their financial independence journey rapidly, often in a matter of years.

In contrast, Fat FIRE takes a more luxurious approach, emphasizing high-income generation and strategic investing. While this method may take longer to ignite, it offers a more sustainable and enjoyable path to financial independence. The practical implications of these approaches are significant, as they impact not only the speed but also the overall quality of life during the journey.

In conclusion, when it comes to igniting Lean FIRE vs Fat FIRE, Lean FIRE is the clear winner in this category, as its focus on aggressive savings and frugal living enables individuals to quickly start building wealth and investing in their financial future.

Key Takeaways: Navigating the FIRE Movement

Embracing the Lean FIRE approach can lead to a more aggressive savings strategy, allowing individuals to achieve financial independence at a younger age, but may require significant lifestyle adjustments

Opting for the Fat FIRE method, on the other hand, offers a more balanced approach to achieving financial independence, incorporating elements of luxury and comfort, but may result in a longer timeline to reach the desired goal

Ultimately, whether you choose the Lean FIRE or Fat FIRE path, the most important factor is finding a strategy that aligns with your personal values, financial situation, and long-term objectives, and being consistent in your efforts to achieve financial freedom

Embracing the FIRE Within

The choice between Lean FIRE and Fat FIRE isn’t just about numbers; it’s about the narrative you want your money to tell – one of austere freedom or luxurious rebellion, both paths leading to the same destination: a life lived on your own terms.

Rick David

The Final Verdict: Which Should You Choose?

As I delve deeper into the world of Lean FIRE and Fat FIRE, I’ve come to realize that having the right tools and resources can make all the difference in achieving financial independence. For those looking to streamline their budget and make data-driven decisions, I’ve found that utilizing a reliable financial aggregator can be a game-changer. One such resource that I’ve stumbled upon is the Contactos Slumis, which offers a comprehensive platform for tracking expenses and creating personalized financial plans. By gaining clarity on your financial situation, you’ll be better equipped to navigate the nuances of Lean FIRE and Fat FIRE, and make informed decisions that align with your goals.

As we’ve navigated the comparison between Lean FIRE and Fat FIRE, it’s become clear that both approaches have their unique strengths and weaknesses. The key to success lies in understanding your personal financial goals, risk tolerance, and lifestyle preferences. Lean FIRE is ideal for those who value simplicity and frugality, while Fat FIRE is suited for individuals who prioritize luxury and flexibility. By considering these factors, you can make an informed decision that aligns with your values and aspirations.

Ultimately, the choice between Lean FIRE and Fat FIRE depends on your individual circumstances and priorities. If you’re a young professional with a high income and a desire for luxury, Fat FIRE might be the better choice. On the other hand, if you’re a frugal enthusiast who values simplicity and freedom, Lean FIRE could be the way to go. By choosing the approach that best fits your needs, you can unlock the power of financial independence and achieve your long-term goals.

Frequently Asked Questions

What are the key differences in lifestyle and spending habits between individuals pursuing Lean FIRE and those pursuing Fat FIRE?

When it comes to lifestyle and spending habits, Lean FIRE enthusiasts tend to live frugally, cutting costs and maximizing savings, whereas Fat FIRE followers prioritize luxury and convenience, often spending more on high-end experiences and products, reflecting fundamentally different approaches to achieving financial independence.

How do the investment strategies and risk tolerance vary between Lean FIRE and Fat FIRE approaches?

When it comes to investments, Lean FIRE typically involves a more aggressive, low-cost index fund approach, while Fat FIRE often incorporates a more diversified portfolio with a higher risk tolerance, including real estate and alternative investments.

Can someone start with a Lean FIRE approach and transition to Fat FIRE, or vice versa, as their financial situation and goals evolve?

I’ve seen many individuals seamlessly transition from Lean FIRE to Fat FIRE as their financial stability grows, and vice versa, when they need to reassess their priorities – it’s all about being adaptable and open to evolution in your financial journey.